New due date for the submission of the tax return form for companies and self-employed.

The Cyprus Tax department has announced on the 22nd of May the new due

Benefits, advantages & Formation Procedure. Learn how international corporations benefit from Cyprus company setup.

How to become a Cyprus Tax resident under the Non-Domicile Status.

A solution for high net work individuals, high earners, entrepreneurs, artists and athletes.

Setup a solid business and economic substance in Cyprus. Tax Plan.

IP Box in Cyprus

Protect your asset and benefit the special tax regime

Alternative Investment Funds in Cyprus

VAT refund, Tax Credit, Cash rebate.

A scheme attracting firm producers from around the world

The Cyprus Tax department has announced on the 22nd of May the new due

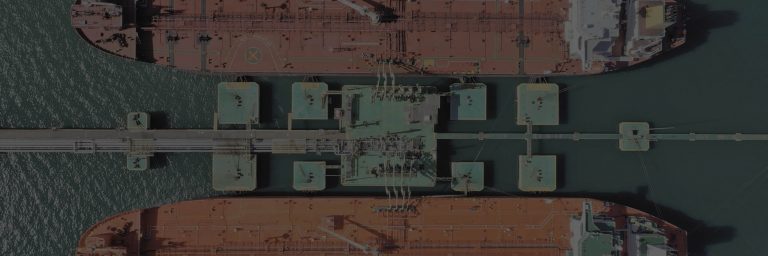

Cyprus is a considered a great Maritime hub and a Tax friendly destination allowing

SPL Audit would like to update businesses regarding the tax measures taken due to

Cyprus government announced on the 15th of March 2020 a package of economic measures

The data showing the course of the Cyprus maritime over the last years is

According to the new law amendment voted by the Cyprus Parliament earlier this month

VIES The withdrawal agreement between UK and EU provides a transitional period from 1/2/2020

Cyprus in the last few years is establishing itself as one of the top

Social Insurance contributions in Cyprus have a rate applied up to a level of

The European Commission approves maritime transport support schemes in Cyprus and other 4 countries.

Follow for updates.